Spring may feel a long way off but it’s not too early to ensure you’re aware of the changes that are coming in April!

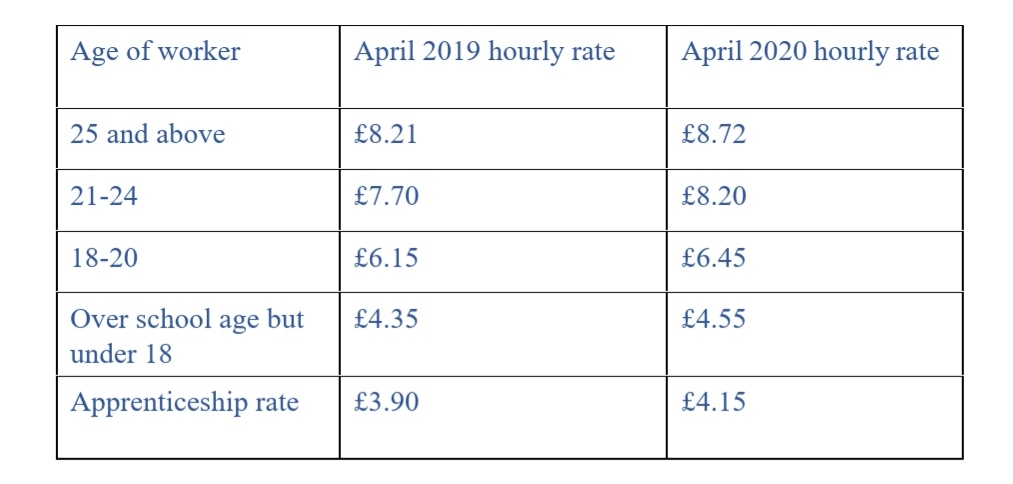

Increase to Minimum Wage (from 1st April 2020)

Rates will increase as follows:

Changes to the reference period for calculating holiday pay

Instead of using a reference period of 12 weeks to calculate any holiday due, for example for casual workers or those on zero hours contracts, the reference period will now need to be 52 weeks. If an employee is employed for under 52 weeks then their holiday pay needs to be based on the number of weeks they have actually worked.

Provision of Employment Contracts or “Section 1 Statement”

All employees and workers who start work after 5th April 2020 must be given a written statement either on or before starting work. This is a ‘day one’ right for all types of workers (not only employees). As well as the information employers already have to provide, the statements must also state:

- the days of the week the employee or worker is required to work

- whether the days or hours might change and how

- details of paid leave apart from sickness or holiday

- details of a probationary period if applicable

- if any training is provided by the employer, as well as any other training the employee or worker needs to undertake which won’t be supplied or funded by the employer.

Those employed prior to 6th April 2020 can also request a statement containing this additional information – employers then have a month to respond to such requests.

Agency workers’ rights

From 6th April 2020, agency workers can no longer opt out of the right to receive equal pay after 12 weeks by becoming employed by the agency (this is known as the Swedish derogation). An agency worker is therefore entitled to the same basic employment conditions as non-agency workers in the same business once they have been working there for 12 weeks. Any agency workers also need to be supplied with a written statement informing them of this right by 30th April 2020.

Increase to employer NICs on termination payments over £30,000

Employer’s National Insurance contributions of 13.8% will become payable on termination payments above £30,000. As it stands, only income tax (and not N.I.) is payable on sums in excess of £30,000.

Increases to statutory rates for maternity, paternity, shared parental pay, adoption and sick pay, as well as statutory awards for redundancy and tribunal.

These rates usually increase from the first Sunday of April, but are yet to be confirmed.

Gender Pay Gap Reporting Deadlines (for companies with 250 employees or more)

The deadline for submitting your 2019 report depends on the sector of the organisation:

- Relevant public sector organisations – 30 March 2020.

- Private company or charity – 4 April 2020.

Informing and Consulting Staff

The percentage of employees needed for a request to negotiate an agreement on informing and consulting employees under the ICE (Information and Consultation of Employees Regulations 2004) changes from 10 per cent to 2 per cent of the workforce, subject to a minimum of 15 employees.

Changes to IR35

Employers that engage ‘off-payroll’ workers through agencies or intermediaries will become responsible for determining their employment status and paying NICs for those who are deemed to be employees. This responsibility previously applied in the public sector but has now been extended to medium and large private sector organisations. For small organisations, the agency or intermediary remains responsible for deciding the employment status of the worker.